London has long been considered one of the world’s premier real estate markets, and it’s luxury and prime property sectors are no exception. From grand townhouses in Mayfair to contemporary penthouses in Knightsbridge, London’s prime property market offers a diverse range of properties that are highly sought after by both domestic and international buyers.

Nerves have settled and the aftershock of the mini-Budget is dissipating,” said Rory Penn, head of London sales at Knight Frank. “However, the true test of strength across all price points will be the spring market.

London Prime Property Market Sales highlights:

– Demand remains strong against the relatively stable economic backdrop and the number of new prospective buyers registering in the first seven weeks of the year in London was 28% higher than the five-year average. Meanwhile, the number of new sales instructions was 36% higher.

– That said, activity is stronger in higher price brackets where there is less reliance on mortgage debt. Around half of the sales in PCL are in cash, as we explored recently. The number of exchanges above £2 million was 66% above the five-year average in January. Below £2 million, the increase was 12%. Meanwhile, the number of new prospective buyers above £2 million was 52% higher, while the rise was 20% in the sub-£2 million brackets.

– Average prices were flat on a quarterly basis in prime central London (PCL) in February, which compares to the decline of 0.6% recorded in the three months to December. Meanwhile, prices in prime outer London (POL) recorded their first monthly rise (0.2%) in February since September.

– On an annual basis, average prices were essentially flat in February in PCL, rising by just 0.9%. While there was a decrease of 0.5% below £1 million, there was a rise of 2.1% between £5 million and £10 million, reflecting the relatively stronger performance of the market in higher price brackets. Meanwhile, there was an increase of 3% in POL. An increase of 1.8% below £1 million compared to a rise of 4.4% above £5 million.

Demand for prime property in London has remained strong over the years, and this is largely due to the city’s reputation as a global financial and cultural hub. Many wealthy individuals and families are drawn to London’s prime property market because of the city’s stable political environment, strong legal system, and high quality of life. Additionally, London’s prime properties are often seen as a safe and stable investment, particularly for those looking to diversify their portfolio.

Despite the ongoing pandemic and the uncertainty surrounding Brexit, the demand for prime property in London has continued to hold steady. In fact, some reports suggest that the pandemic has actually increased the demand for prime property as people seek more space and privacy in their homes.

However, while demand for prime property in London remains high, the supply of properties has been somewhat limited. This is partly due to the city’s strict planning regulations, which make it difficult to develop new properties in certain areas. As a result, many prime properties in London are historic buildings that have been converted into luxury apartments or townhouses.

Another factor that has impacted the prime property market in London is the value of the pound. In recent years, the pound has fluctuated significantly due to Brexit and other economic factors. This has made London’s prime properties more affordable for international buyers, particularly those from countries with stronger currencies. As a result, the number of international buyers investing in London’s prime property market has increased in recent years.

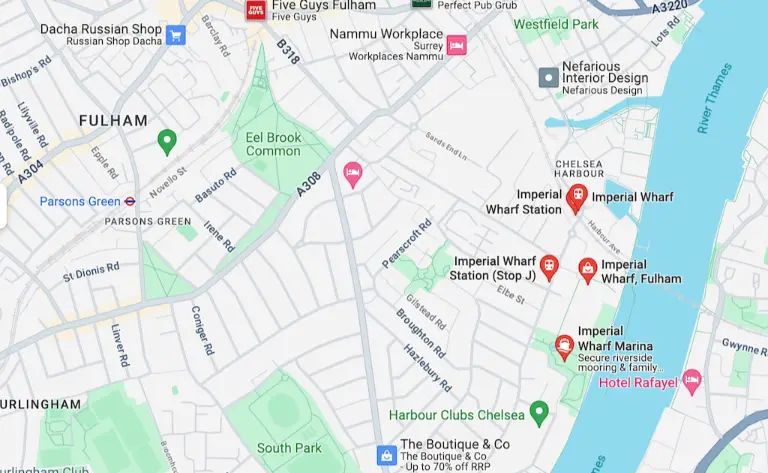

One of the most significant trends in London’s prime property market is the rise of technology-driven luxury developments. These developments often offer state-of-the-art amenities, such as smart home technology and 24-hour concierge services, that are designed to appeal to affluent buyers. Additionally, many of these developments are located in up-and-coming areas of the city, such as Shoreditch and Hackney, which are attracting a younger and more diverse group of buyers.

Overall, the luxury and prime property markets in London are thriving, with strong demand from both domestic and international buyers. While there are challenges related to supply and currency fluctuations, London’s prime properties continue to be seen as a sound investment and a symbol of prestige and success. As such, the city’s prime property market is likely to remain a key player in the global real estate market for years to come.

London Prime Property Market Lettings highlights:

– Compared to the first two weeks of 2023, the number of lettings instructions in London was 21% lower in the second fortnight of the year and 12% down in the following two-week period.

– Rental values are still 26% higher in prime central London (PCL) than before the pandemic while the equivalent figure in prime outer London is 23%.

– Average rental values grew by 18% in the year to February in PCL while the equivalent rise in POL was 15.6%.

– Rents have been pushed higher by stock shortages over the last 18 months, while the re-opening of offices and universities has boosted demand. Supply has struggled to keep pace as owners took advantage of a resurgent sales market, which was turbo-charged by a stamp duty holiday. Prospective landlords have also been put off by tax hikes in recent years and the prospect of further legislative changes, intensifying upwards pressure on rents. It means prospective tenants could face the frustration of supply that stays lower for longer.

“The strength of the sales market since Christmas has taken most people by surprise,” said Gary Hall, head of lettings at Knight Frank. “It means the flow of stock we had started to see come across to the lettings market in some areas has slowed down. This will keep supply tight and maintain upwards pressure on rents in the short-term.”

“Based on the evidence of the last few weeks, it looks increasingly unlikely that the lettings market will return to any sense of normality this year,” said David Mumby, head of prime central London lettings at Knight Frank. “Despite an initial flurry at the start of January, stock levels again feel low across all price points and prospective tenants will need to remain decisive when looking for a rental property.”