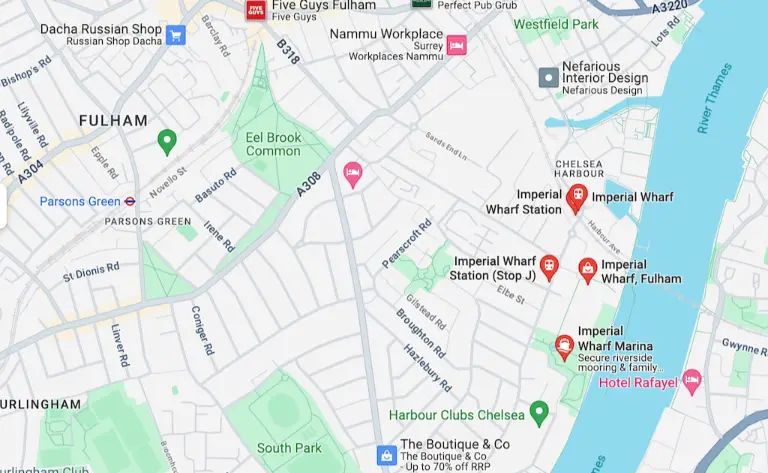

The journey to homeownership is thrilling, yet it can often seem daunting, especially for first-time buyers navigating the complex world of mortgages, deposits, and interest rates. Amidst these challenges, innovative schemes like Own New Rate Reducer emerge as beacons of hope, designed to make the dream of owning a home more attainable. In this guide, we’ll explore how the Own New Rate Reducer scheme works and break down its components to help you understand if it’s the right path for you.

Understanding Own New Rate Reducer

Own New Rate Reducer is a transformative scheme aimed at individuals looking to purchase new build homes. It stands out by offering potential homeowners access to lower mortgage rates and reduced monthly payments. This initiative is not just for first-time buyers but is also available to existing homeowners looking to move.

How Does Own New Work?

- Find Your Home: Start by identifying a new build home eligible under the scheme.

- Mortgage Arrangement: Work with an approved Own New mortgage broker to arrange your mortgage. They will help you decide whether the Rate Reducer or Deposit Drop is more suitable for your situation.

- Enjoy Homeownership: Successfully purchase your home and own 100% of it, stepping into the world of homeownership with potentially lower financial strain.

The scheme operates by providing a financial contribution towards the purchase of your new home, which directly impacts your mortgage. Depending on the construction stage of your chosen property, the scheme could contribute either 3% or 5% of the purchase price. This contribution is made directly to your mortgage lender via Own New, a third party, allowing you to benefit from a reduced mortgage interest rate—potentially lowering it by up to 3.19%.

The immediate benefit is the possibility of lower monthly mortgage payments during the initial 2-5 years of your mortgage term, easing your financial burden and making homeownership more accessible.

Key Benefits and Features

-

- Reduced Rates & Smaller Deposits: One of the scheme’s standout features is the opportunity to secure a mortgage with a low interest rate and a deposit as small as 5%. This means you can own 100% of your home right from the start, whether you are employed or self-employed.

-

- Choice of Products: Own New offers two products under this scheme:

-

- Rate Reducer: This product aims to alleviate the financial strain by offering a reduced mortgage rate, leading to lower monthly payments for a specified period.

-

- Deposit Drop: Ideal for those struggling to save for a larger deposit, this product enables you to buy your new home with just a 5% deposit, without compromising on competitive rates.

-

- Choice of Products: Own New offers two products under this scheme:

Is It Right for You?

The Own New – Rate Reducer scheme offers an appealing solution for those finding the traditional route to homeownership challenging due to high interest rates and large deposit requirements. It’s especially suitable if you’re keen on buying a new build property and are looking for financial flexibility during the initial years of your mortgage.

Before proceeding, it’s crucial to understand all aspects of the scheme, including the long-term implications for your financial situation. Consulting with a financial advisor or mortgage broker approved by Own New can provide clarity and ensure you’re making the best decision for your circumstances.

The path to homeownership in London is becoming increasingly innovative, with schemes like Own New – Rate Reducer offering a lifeline to those dreaming of their own home but deterred by financial constraints. By reducing mortgage rates and deposits, this scheme opens the door to a wider pool of prospective homeowners, making the seemingly distant dream of owning a new build home a tangible reality. Could this be the key to unlocking your homeownership journey?