The journey towards homeownership in London, a city known for its vibrant culture and bustling streets, is often met with the challenge of high property prices. However, the London Living Rent and Rent to Buy scheme emerges as a beacon of hope for many aspiring homeowners. This innovative program is designed to bridge the gap between renting and buying, offering a unique pathway to secure a home in the UK’s dynamic capital.

Understanding Rent to Buy:

At its core, the Rent to Buy scheme is a government initiative aimed at making homeownership more accessible. It allows individuals to rent a property at a reduced rate, typically around 20% below the market value, for a fixed period. This period of lower rent enables tenants to save for a deposit, paving the way to purchase the property eventually. The scheme is particularly tailored towards first-time buyers or those who have previously owned a home but now find it financially challenging to buy.

What is London Living Rent?

London Living Rent is a progressive housing initiative established by the Mayor of London, aimed at aiding middle-income households in transitioning from renting to homeownership, particularly through shared ownership. This scheme is part of the Mayor’s ‘genuinely affordable’ homes agenda, alongside Social Rent, London Affordable Rent, and London Shared Ownership, which are targeted at low-income families.

Rental Costs:

- Variability: Rent amounts under the London Living Rent vary based on the location within London.

- Benchmark Rents: The Mayor sets benchmark London Living Rent levels for each neighbourhood, updated annually. These benchmarks are calculated as one-third of the average local household income, adjusted for the number of bedrooms in the home.

- Average Rent: For a 2-bedroom London Living Rent home, the average monthly rent is approximately £1,077, which is almost three-quarters lower than the median market rent in London.

- Family-Sized Homes: To maintain affordability, the rent for a 3-bedroom home is capped at no more than 10% higher than that for a 2-bedroom property.

This initiative marks a significant step in making London housing more accessible and providing a viable route to homeownership for those who find themselves priced out of the traditional housing market.

Benefits of the Scheme in London:

- Affordability: With the reduced rent, deposit savings become more feasible for many Londoners.

- Flexibility: Tenants have the option to buy the property after the rental period or continue renting.

- Test Before You Buy: Living in the property before purchasing offers a unique opportunity to get to know your potential future home and neighbourhood.

- Quality Housing Options: Rent to Buy properties in London are often new builds or recently refurbished, ensuring modern living standards.

Showcasing Rent to Buy Properties in London:

Barking Riverside L&Q

Barking Riverside, a groundbreaking development project jointly undertaken by L&Q and The Mayor of London, is reshaping a historic 443-acre brownfield site along 2km of the River Thames’ south-facing frontage. This transformative venture, which repurposes a former 1920s power station site, is poised to become one of Europe’s most extensive and impressive urban redevelopment.

| Prices | |

| 1 Bedroom | £1,088 pcm |

| 2 Bedrooms | £1,209 pcm |

| 3 Bedrooms | £1,329 pcm |

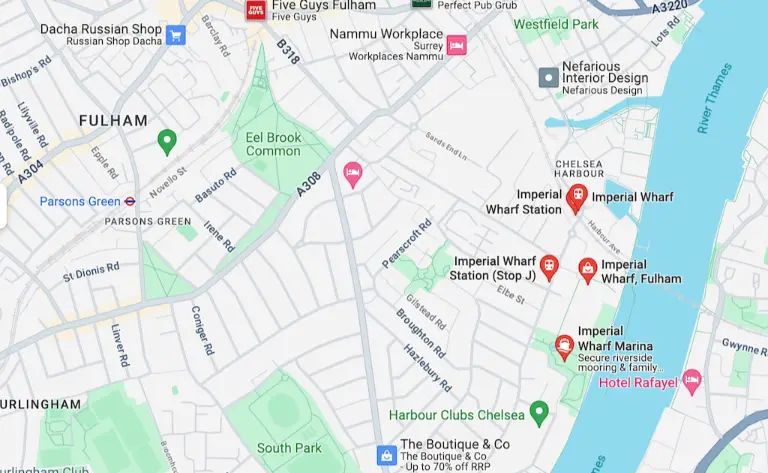

Regency Heights Park Royal

Exciting opportunities await first-time buyers at L&Q at Regency Heights, Park Royal, with a superb collection of 1 & 2-bedroom homes now available through the London Living Rent scheme. Perfectly situated within one of London’s most significant regeneration projects, these homes are ready for immediate move-in, offering a fantastic stepping stone towards homeownership in the vibrant district of Brent.

As a part of the Old Oak and Park Royal development, the area is witnessing a tremendous transformation, with substantial investments pouring into transport, infrastructure, arts, and culture. This surge of development is rapidly turning the area into one of the most pivotal and thrilling districts in London.

The residences at Regency Heights have been designed with modern living in mind. Each home features a private outdoor space, ideal for relaxation and entertaining. The open-plan living areas, coupled with floor-to-ceiling windows, ensure that each apartment is bathed in natural light, creating an inviting and spacious atmosphere.

| Prices | |

| 1 Bedroom | £956 pcm |

| 2 Bedrooms | £1,062 pcm |

Eligibility Criteria:

To be considered for the Rent to Buy scheme, applicants must meet the following requirements:

- Employment: Applicants should be in full-time or part-time employment.

- First-Time Buyers: The scheme is primarily aimed at individuals who have not owned a property before.

- Financial Stability: Potential tenants must demonstrate the ability to pay rent and simultaneously save for a deposit.

- Previous Homeowners: Those who are returning to homeownership following a relationship breakdown may also be eligible.

Landlords participating in the Rent to Buy scheme will typically conduct income and credit history checks to determine eligibility.

Is the Rent to Buy scheme a good idea?

- Reduced Rent: The scheme’s reduced rent rates make saving for a deposit more achievable in London’s competitive property market.

- Flexibility: Tenants have the option to purchase the property after the rental period, offering a secure path to homeownership.

- Quality Living: Rent to Buy properties are often new or recently renovated, ensuring a high standard of living.

- Test Drive Your Home: This scheme allows you to experience the property and the area before committing to purchase.