Post Code battle: SW3, W11 winning, SW7, SW1 losing out

A recent London prime property index was carried out by Coutts and revealed that activity in the London prime property market continued to rise in Q1. Subsequently, this reflects that the conditions of lockdown have not negatively impacted prime property purchases. Coutts’ data also indicated that more buyers are prioritising outdoor space.

Demand in Central London significantly decreased compared to the post-election surge the property market saw last year. However, Central London is still being considered by buyers with areas offering bigger homes and green space gaining the most interest.

According to Peter Flavel, Coutts CEO, the market has become febrile due to prime properties experiencing a 27.3% increase in sales, a 4.7% price decrease, and selling 18 days faster. He also comments that:

“Stamp Duty holidays and the impending surcharge for non-resident buyers have disrupted usual market patterns. My conversations with clients suggest they’re thinking more about the quality of their lives at home than these measures. The last 12 months have made it clearer than ever that home is about making a family life you want to live, not just pennies and pounds.”

Chelsea, which previously recorded a 22.7% annual increase in sales in Q1 2020, also saw a 39.3% increase in Q1 2021. This Prime London hotspot was then followed by Kensington, Notting Hill, and Holland Park, which recorded a 44.4% annual increase in Q1 2021, following a 12.3% rise in sales in 2020. However, South Kensington recorded 14.9% fewer sales in Q1 2021, despite experiencing a boom in sales a year ago.

London Breakdown:

- Hampstead, Highgate, Barnet & Haringey

Annual growth in prices of 4.6% made this our best performing area in Q1.

- St John’s Wood, Regents Park and Primrose Hill

One of the busiest markets in Q1 with a 79.4% annual increase in sales in and 34.2% more properties listed for sale.

- Kings cross & Islington

Less stock on the market this year than last means properties here sell more quickly here than elsewhere in London, an average of 135 days compared to 154 across all prime London this quarter.

- Marylebone, Fitzrovia & Soho

This area saw the highest annual fall in prices in Q1, but sales up 40.6% on Q1 2020.

- Mayfair & St James’s

Buyers here paid the highest average price of any prime London area this quarter, with the number of properties sold between £2million and £5 million doubling compared with Q1 last year.

- Knightsbridge & Belgravia

This area recorded the highest annual fall in sales in Q1 but a 33.3% annual increase in properties under offer suggests Q2 could see activity increase.

- Pimlico, Westminster & Victoria

This area has seen the highest annual change in properties under offer, up 50%, but there is still plenty of choice with 39.2% more properties on the market than at the end of Q1 last year.

The market below £1million was particularly busy here this quarter, with the number of sales 73.2% higher than in Q1 last year.

- Battersea, Clapham and Wandsworth

Demand for family houses continues to support activity with 37.2% more homes sold in Q1. But fewer homes were listed in Q1, a -26.4% annual fall.

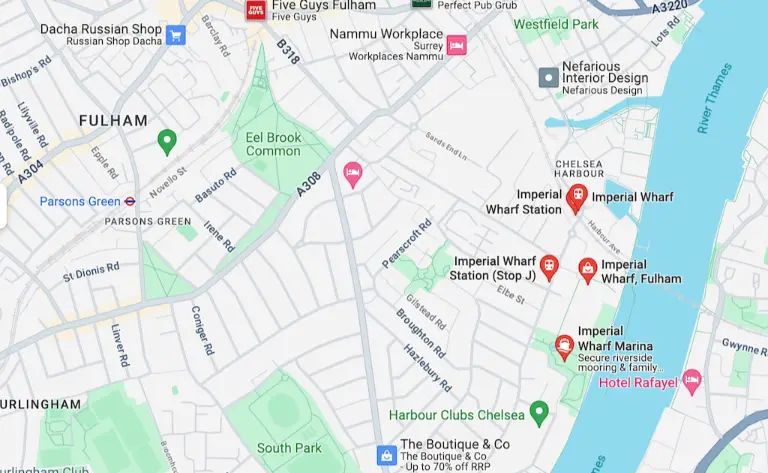

- Fulham & Earls Court

43.3% more properties under offer here this year than last. But there is still a good amount of stock on the market, up 55.6% on Q1 2020.

- Chelsea

Price growth of 4.3% over the last 12 months the means this is second best performing of our prime London areas in Q1.

- Hammersmith & Chiswick

One of the busiest areas for sales in Q1 but a rush to complete before the end of March means under offer volumes were down -20.6% at the end of Q1 this year compared with the same point a year earlier.

- South Kensington

12.0% more properties under offer than Q1 2020 and sales up 29.0% on Q4 2020 suggest the market is picking up here.

- Kensington, Notting Hill & Holland Park

A busy first quarter in Kensington, Notting Hill & Holland Park not only saw 44.4% more properties sold but also a 26.4% annual increase in properties under offer.

- Bayswater & Maida Vale

This area saw a 38.3% annual increase in new listings in Q1, the highest of any prime London area.